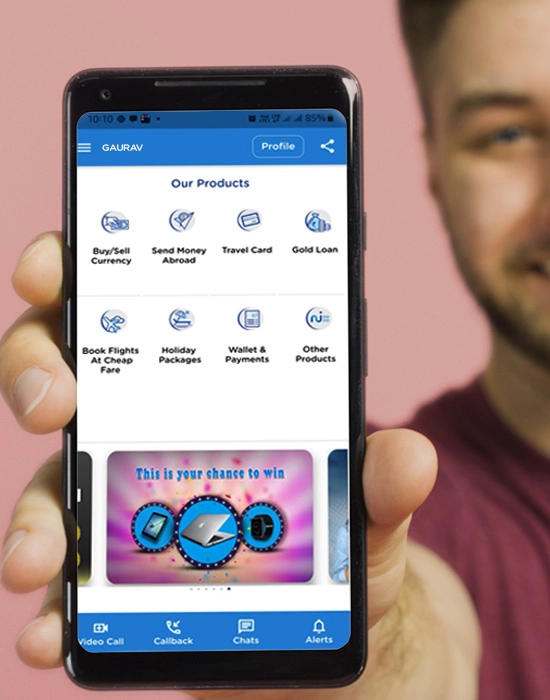

Unimoni Wallet- Digital Wallet App

Unimoni Wallet is a digital wallet app that is an all-in-one solution for online bill payments and instant money transfers. Store your funds digitally, eliminating the need for physical cash or cards! Users can send and receive funds within seconds through this online payment app, enabling swift transactions. A fast and secure way for online money transfers!

The safe, smart, reliable mobile payment App

Tired of time-consuming and exhausting queues to make utility bill payments? Worried about carrying cash and having enough change to pay at shops and establishments? Make life easy for yourself with Unimoni Wallet. Its smarter payments options through Mobile App will make mobile recharge, utility bill payment, money transfer, and payment of school fees etc. very simple. Download the app on your mobile phone from the relevant app store and you will discover that its convenience is just what you need to keep it all together. Unimoni Wallet offers the highest levels of simplicity and security. It offers the most reliable security of your personalised OTP. With every payment feature tested and backed by world-class technology

Branch Locator

Services

Uses of unimoni app

- Load Money to your account

- Make a Wallet to Wallet transfer

- Make a Merchant Payment at any Shop

- Scan the QR code & make payments

- Pay for Mobile & DTH recharge

- Pay Postpaid & Land phone bills

- Pay Gas, Electricity & Water bills

- Make Instant money transfers to any bank account in India in association with NPCI

- Buy Health Plans of Indian Health Organization (IHO)